Need help? Call us: (949) 849-0599

We will help you with a free consult!

YOUR FINANCIAL PARTNER

Preserving wealth through Real Estate.

True story. There was a guy with a Mercedes G-Wagon and a big watch at the gym looking baller. My friend overheard him on a call saying, “The best we can do for you is a 1% CD.” My friend felt that didn’t sound quite right and Googled CD rates. They were around 4%. My friend realized this guy’s getting taken advantage of. If this is you, you are not alone.

There are a lot of “financial experts” out to make a quick buck, but we want to help people avoid being misled. We want to avoid misleading people into calls like with the Mercedes G-Wagon with that big watch. We are here to help be your partner not be your broker.

Real Estate

Subjects to be covered

What is Estate Planning

Why Estate Planning

Celebrity Case Studies

Revocable Living Trust

Irrevocable Trust

Get Your Free Consult TODAY!!!

About

Andrew Chavez

I am an established Financial Professional with Apex Innovative Financial & Insurance Solutions, stands out as a financial services organization in Orange County, CA. With nearly a decade of experience, I have had the privilege of collaborating with a diverse range of individuals, families, and businesses, guiding them toward financial prosperity and successful wealth accumulation.

Having laid a solid foundation through his early career in finance, I seamlessly transitioned into a role that empowered me to establish a robust and comprehensive financial services practice. My background in the banking industry, combined with his amiable disposition and unwavering work ethic, has left an indelible mark on the lives of my clients.

When I'm not immersed in my professional endeavors, I cherish quality time with my family and friends. I enjoy playing golf and embarking on adventures with my lovely girlfriend Jacklyn, as we travel and explore new horizons together.

I am insurance licensed in California, Texas, New York, Mississippi, Michigan, Illinois, Washington, Louisiana, Colorado, Oregon, Virginia, Nevada, Arizona, and Connecticut.

CA Insurance License#: 0M02992

Creating a Roadmap for Your Assets

What Is Estate Planning?

Estate planning is the process of creating a roadmap for your assets—deciding what happens to everything you own when you’re gone or unable to make decisions. A proper estate plan typically includes:

Revocable Living Trust – Keeps control in your hands while avoiding probate.

Irrevocable Trust – Provides stronger asset protection and potential tax advantages.

Will and Pourover Will – Ensures everything not in your trust is still properly distributed.

Power of Attorney – Authorizes someone you trust to handle financial decisions if you can’t.

Healthcare Directive – Guides your loved ones through medical decisions on your behalf.

Why It Matters?

Without an estate plan, your assets enter probate court, where fees, delays, and family conflicts can drain everything you’ve built. Here’s the truth:

99% of inheritances are spent within six months.

Probate fees can consume 7% or more of your estate’s total value.

Even celebrities like Prince, Aretha Franklin, and Michael Jackson faced years—or decades—of court battles because they didn’t have the right documents in place.

You want to make sure you have asset protection from legal pitfalls and they go to intended beneficiaries. You also want to make sure you take the tax benefits by reducing tax burden on your heirs.

Celebrity Is As Celebrity Does

Aretha Franklin

When Aretha Franklin passed away in 2018, the world mourned a legend—but her family was left with confusion and conflict. For years, they believed she had no will. Then, two handwritten wills surfaced: one from 2010 stored safely in a locked cabinet, and another from 2014 found crumpled in the cushions of her living room couch.

Each document told a different story about how her multimillion-dollar estate should be divided. The 2010 will gave her four sons equal shares, but the later 2014 version adjusted inheritances and added specific conditions. The family fought in court for years over which will was valid. In the end, the 2014 couch-cushion document won—but not before draining huge amounts of money and goodwill from the estate.

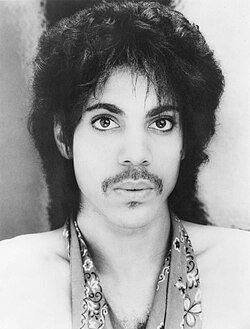

Prince

When music icon Prince died in 2016, his sudden passing shocked the world. But the bigger shock came after—he had no will, no trust, and no estate plan at all. Despite a net worth of around $200 million, he left behind no legal instructions for what should happen next.

What followed was a legal circus. Dozens of people came forward claiming to be relatives or entitled heirs. The court had to spend years verifying who was truly family. Meanwhile, taxes and legal fees piled up. By the time the estate was finally settled—nearly six years later—the government had collected tens of millions in estate taxes, and much of the original fortune had been chipped away by attorneys, appraisers, and administrative costs.

Michael Jackson

Michael Jackson’s case shows how financial neglect and poor tax planning can spiral out of control. At his death in 2009, Jackson’s estate was estimated at $500–$800 million, but he owed massive back taxes and penalties. The IRS and his estate executors have been in court battles ever since—over 15 years later—arguing about valuations and unpaid taxes.

As the years passed, his tax debt swelled to over $700 million, leaving his family locked in legal disputes and unable to access much of the estate’s wealth. What’s tragic is that Jackson actually had a trust, but it wasn’t properly funded—meaning his assets weren’t legally transferred into it. The result? Everything still had to go through probate court, defeating the purpose of the trust in the first place.

The Vanderbilt Family

In the late 1800s, the Vanderbilts were the wealthiest family in America. Cornelius Vanderbilt turned a $100 loan into one of the largest fortunes in history through shipping and railroads. Adjusted for inflation, his family’s wealth would be worth hundreds of billions—possibly trillions—today.

But within just two generations, almost all of it was gone. Why? The family relied solely on simple wills and verbal agreements instead of setting up dynasty trusts or structured plans to preserve their fortune. As money passed from one generation to the next, it was spent freely—on lavish estates, social events, and unchecked lifestyles.

By the 1970s, when family descendants gathered for a reunion at Vanderbilt University (named after their ancestor), not a single one was a millionaire.

Revocable Living Trust

A Revocable Living Trust is one of the most practical and complete tools in estate planning. It allows you to organize your assets, protect your loved ones, and maintain full authority over your financial legacy while you’re still alive. Unlike a will, which only takes effect after death, a living trust becomes active the moment it’s signed and funded. It serves as your personal roadmap—outlining exactly how your assets should be managed during your life and distributed after.

Flexibility: Life changes constantly, and your estate plan should change with it. A Revocable Living Trust gives you the ability to make adjustments at any time. If you buy a new property, welcome a new family member, or change your goals, you can easily amend or revoke the trust. You stay in charge as the trustee, managing your assets the same way you always have. This flexibility makes the trust a living document—something that grows, adapts, and evolves with you as your circumstances shift over time.

Privacy: Unlike a will, which becomes public record once it enters probate court, a Revocable Living Trust keeps your affairs private. No one outside your family or trusted advisors needs to know what you owned or who inherits it. The trust acts as a private agreement between you, your trustee, and your beneficiaries. This confidentiality spares your loved ones from public scrutiny, reduces the risk of family tension, and prevents opportunists or creditors from learning about your estate. Privacy isn’t just about secrecy—it’s about protecting your family’s dignity and peace of mind.

Probate Avoidance: Probate is the legal process of validating a will, paying debts, and distributing assets. It’s slow, costly, and entirely public. Court fees, attorney costs, and delays can erode an estate’s value by as much as 5–7%. A properly funded Revocable Living Trust bypasses probate completely. Assets are distributed directly and privately to your beneficiaries without the oversight of a judge. This saves your family time, stress, and money—allowing them to move forward quickly after a loss rather than waiting months or years for the court to act.

Protection: While a Revocable Living Trust doesn’t offer the same level of legal protection as an irrevocable trust, it still provides strong safeguards for your family. It prevents mismanagement by naming responsible trustees to oversee distributions and ensures that minor children or vulnerable beneficiaries have someone managing their inheritance wisely. For example, if life insurance is left directly to a child, the court will appoint someone to control the money until they turn 18. With a trust, those funds can be used immediately for their care and education under your chosen trustee’s direction. A trust also allows you to put parameters in place—so assets are used responsibly and preserved for the right reasons.

Control: A Revocable Living Trust keeps you in complete control of your estate. You decide who manages your finances if you become incapacitated, who inherits your assets, and how those assets are distributed. You can set specific conditions—like providing funds gradually over time, restricting access during substance abuse, or ensuring money is used for education or housing. Even after you’re gone, your trust continues to carry out your wishes exactly as written. It acts as your voice, protecting your intentions and ensuring your legacy is managed the way you envisioned.

Irrevocable Trust

An Irrevocable Trust is designed for people who want to take estate planning beyond simplicity and privacy—to create real, lasting protection. Unlike a revocable trust, which you can change at any time, an irrevocable trust is permanent once established. That permanence is what gives it its power. By moving assets into an irrevocable trust, you remove them from your personal ownership, creating a legally separate entity that offers unparalleled protection, security, and tax efficiency.

Permanent

An irrevocable trust is built to last. Once assets are transferred, they no longer belong to you personally—they belong to the trust. This permanence is intentional. It ensures that your wealth is shielded from personal liabilities, lawsuits, and even future policy changes. Though this structure limits your direct access to the assets, it provides stability and guarantees that your plan cannot be undone or challenged easily. For those with larger estates or long-term family objectives, permanence creates certainty that your legacy will stand exactly as designed.

Secure

Security is the defining feature of an irrevocable trust. Because the assets inside are no longer under your direct ownership, they’re insulated from personal creditors, lawsuits, and certain types of judgments. The trust becomes its own protected entity, managed by appointed trustees according to the instructions you’ve written. This structure ensures that even in times of financial hardship, legal disputes, or business risks, your family’s inheritance remains untouched. The peace of mind that comes with knowing your wealth is secure for future generations is what makes irrevocable trusts a cornerstone of advanced estate planning.

Legacy

An irrevocable trust is a legacy-builder. It allows you to decide exactly how your wealth is distributed—not just to your children, but to future generations. You can create a dynasty trust, designed to last hundreds of years, preserving wealth, investments, and even family values over time. By setting clear rules, you can ensure that assets are used wisely—funding education, supporting charitable giving, or maintaining family-owned businesses. Instead of passing down just money, you pass down structure, purpose, and long-term stability.

Tax Advantages

Tax efficiency is one of the most powerful benefits of an irrevocable trust. Because the assets are no longer part of your taxable estate, they’re often excluded from estate taxes. For high-net-worth individuals, this can mean saving millions that would otherwise go to the IRS. Certain types of irrevocable trusts—like Irrevocable Life Insurance Trusts (ILITs)—also keep life insurance proceeds outside your taxable estate, ensuring the full benefit goes to your heirs. In addition, income and capital gains generated inside some irrevocable trusts can be taxed at lower rates or deferred entirely, depending on structure.

Properly designed, an irrevocable trust transforms your estate plan from simple protection into a strategy for generational wealth and tax optimization.

In case you're one of those people (like me) who just skip to the end of the page, here's the deal:

I'm offering you a consolation 100% FREE. Yes, free, and all you pay is a hour of your time.

There's no catch... no gimmicks... You will NOT be signing up for any "trial" to some monthly program or anything like that.

If fact, if you don't love thew library of information we will offer you to help you render your own decision YOU DON'T NEED TO DO A THING.

That is a promise.