Need help? Call us: (949) 849-0599

We will help you with a free consult!

YOUR FINANCIAL PARTNER

The Real Truth About Retirement Planning.

True story. There was a guy with a Mercedes G-Wagon and a big watch at the gym looking baller. My friend overheard him on a call saying, “The best we can do for you is a 1% CD.” My friend felt that didn’t sound quite right and Googled CD rates. They were around 4%. My friend realized this guy’s getting taken advantage of. If this is you, you are not alone.

There are a lot of “financial experts” out to make a quick buck, but we want to help people avoid being misled. We want to avoid misleading people into calls like with the Mercedes G-Wagon with that big watch. We are here to help be your partner not be your broker.

Retirement

Subjects to be covered

Common Fears

Myths

Phases of Retirement

Market Volatility

Sequence of Returns

Fixed Index Annuity

Traditional Planning

Get Your Free Consult TODAY!!!

About

Andrew Chavez

I am an established Financial Professional with Apex Innovative Financial & Insurance Solutions, stands out as a financial services organization in Orange County, CA. With nearly a decade of experience, I have had the privilege of collaborating with a diverse range of individuals, families, and businesses, guiding them toward financial prosperity and successful wealth accumulation.

Having laid a solid foundation through his early career in finance, I seamlessly transitioned into a role that empowered me to establish a robust and comprehensive financial services practice. My background in the banking industry, combined with his amiable disposition and unwavering work ethic, has left an indelible mark on the lives of my clients.

When I'm not immersed in my professional endeavors, I cherish quality time with my family and friends. I enjoy playing golf and embarking on adventures with my lovely girlfriend Jacklyn, as we travel and explore new horizons together.

I am insurance licensed in California, Texas, New York, Mississippi, Michigan, Illinois, Washington, Louisiana, Colorado, Oregon, Virginia, Nevada, Arizona, and Connecticut.

CA Insurance License#: 0M02992

Common Fears

Setting the Stage

Running out of money.

This is the fear under every other fear. It isn’t about a number on a statement—it’s about freedom and dignity. The real culprit isn’t “not enough growth,” it’s the combo of sequence-of-returns risk, fee drag, and taxes siphoning cash flow over 25–30 years. Our fix is structural: cover your must-have lifestyle with guaranteed lifetime income (so groceries, housing, healthcare aren’t market-dependent), build a tax-free bucket so gross ≈ net, and let your market bucket focus on long-term growth instead of paying monthly bills. When essential income is guaranteed and tax-efficient, the probability of depletion drops dramatically.

Market crashes.

Volatility isn’t the problem; when it shows up is. Two bad years early in retirement can wreck a “safe” plan that looked fine on averages. We remove that fragility by carving out a protected income base (e.g., FIA/income rider) so a 2000–2002 or 2008 event doesn’t force you to sell low to fund withdrawals. The protected base pays checks through down cycles; the equity sleeve gets time to recover, turning crashes from existential threats into temporary setbacks.

Rising taxes.

Future tax rates are unknowable, but your exposure to them is controllable. Relying on pre-tax only is like entering a business partnership where the IRS sets its ownership share later. We shrink that risk with Roth contributions where available (ideally with Roth match), staged Roth conversions (often most efficient in the 60–70 window), and properly designed cash-value life insurance for tax-free distributions. The aim is simple: take the government out of your retirement math so policy changes don’t change your lifestyle.

Common Mistakes

“Your portfolio’s average return determines your success.”

“You’ll be in a lower tax bracket when you retire.”

“The 4% withdrawal rule will keep you safe.”

“All financial advisors are fiduciaries acting in your best interest.”

“The market always comes back—just ride it out.”

Top Myths Debunked

Stock Market Averages

The word average is the industry’s favorite illusion. Advisors quote 8%, 10%, even 12% “average returns” as if they’re guarantees. But averages hide the one thing that matters most—sequence of returns. If you lose 50% one year and gain 100% the next, the average return is +25%, but your account is only back where it started. During accumulation, time can heal losses; in retirement, it can’t. Every withdrawal during a downturn locks in losses permanently. That’s why two investors with the same “average return” can end up hundreds of thousands of dollars apart. We teach clients to focus on actual returns net of fees, not marketing math. Real retirement planning is about consistency, not averages.

Lower Tax Bracket

That line has been repeated for decades—and it’s flat-out wrong for most people. If your advisor says that, what they’re really saying is, “I plan to make you poorer in retirement.” The goal isn’t less income; it’s smarter income. Historically, tax rates have been far higher than they are now—91% in the 1950s, 70% in the 1970s, 39.6% as recently as the early 2000s. Combine rising debt, Social Security, and Medicare shortfalls, and there’s only one direction taxes can realistically go. Relying on pre-tax accounts (401(k)s, IRAs) means you’re effectively in business with the government—and they decide their cut later. We shift clients toward Roth accounts, Roth conversions, and tax-free income streams like properly designed cash-value life insurance, so that when taxes rise, your income doesn’t change.

4% Withdraw Is Safe

That “rule” came from a 1990s study using outdated data, shorter life expectancies, and a very different market environment. Today’s retirees face longer lives, lower bond yields, and more volatility—making 4% not just outdated but dangerous. If you retired in 2000 or 2008, you could’ve run out of money in under 15 years using the 4% rule. A modern strategy uses guaranteed income tools like Fixed Indexed Annuities (FIAs) or income riders that can safely provide 7–8% lifetime income with no risk of depletion. These solutions aren’t about “chasing returns”—they’re about removing risk and stabilizing cash flow. The new rule of retirement isn’t withdrawal-based—it’s income-engineered.ed opportunities to let their money work for them.

Advisors Working For You

“Fiduciary” sounds comforting, but the truth is that many advisors are trained to protect their firm’s income before yours. Most are paid through Assets Under Management (AUM) fees, meaning their earnings depend on how much of your money stays in their accounts. That’s why you’ll often hear, “Don’t buy annuities,” or “You’ll lose liquidity”—because transferring part of your portfolio into an annuity or life insurance takes assets out of their fee base. Similarly, some insurance agents only sell one product type, steering everyone into the same solution whether it fits or not. We expose those conflicts of interest by showing side-by-side comparisons of returns, fees, and long-term income outcomes. Real fiduciary advice puts the client’s retirement income first, not the advisor’s recurring revenue.

Stock Market Recovery

Sure, markets recover—but that’s not helpful if you’re withdrawing during the fall. Retirement isn’t about “waiting it out”; it’s about sequencing risk so a bad decade doesn’t destroy 30 years of savings. When Berkshire Hathaway sells all its S&P holdings at market highs, that’s not fear—it’s discipline. You don’t have to abandon the market, but you do need to carve out protected income streams that don’t depend on Wall Street behaving perfectly. With the right mix of growth, protection, and tax strategy, you can enjoy market upside without being held hostage by it.

Phases of Retirement

Accumulation

The accumulation phase is the foundation of your financial life, typically spanning from your 20s through your 40s or early 50s. This is when your money should be working as hard as you are. The goal is to grow assets while building the tax flexibility you’ll need later. Roth IRAs and Roth 401(k)s are powerful tools here, allowing tax-free growth and withdrawals in retirement. For higher earners who exceed Roth contribution limits, an Indexed Universal Life policy (IUL) offers similar benefits with added protection from market downturns. Risk management in this stage means diversification and consistency, not gambling on high-risk returns. By pairing market-based investments with tax-free growth vehicles, you build wealth intelligently—setting up a structure that grows efficiently while protecting you from the volatility that can erase progress.

Protection

The protection phase begins as you approach your 50s or early 60s, when the focus shifts from maximizing returns to preserving what you’ve worked so hard to build. This is where true retirement planning begins—balancing growth with safety and preparing for income distribution. Fixed Indexed Annuities (FIAs) become essential tools, offering growth linked to market performance but with zero downside risk. Income annuities can guarantee a paycheck for life, ensuring that market crashes or economic shifts won’t disrupt your retirement lifestyle. Overfunded cash value life insurance also shines in this phase, offering tax-free accumulation, long-term care flexibility, and an additional safety net for income gaps. The purpose here is to reduce exposure to volatility while strengthening your position against taxes, inflation, and longevity risk—turning fragile growth into lasting stability.

Distribution

The distribution phase is where everything comes together. This is your time to enjoy the wealth you’ve built and create a reliable income that lasts for life. The goal is to convert your savings into steady, predictable cash flow without running out of money or being at the mercy of the market. Fixed Indexed and Income Annuities offer guaranteed lifetime income, allowing you to spend confidently without worrying about market declines. Cash value life insurance, such as IULs or whole life, provides tax-free retirement income through withdrawals or loans, and also ensures your loved ones receive a legacy that bypasses taxes and probate. The right plan blends protection and flexibility—giving you income today, security tomorrow, and peace of mind for the generations that follow.

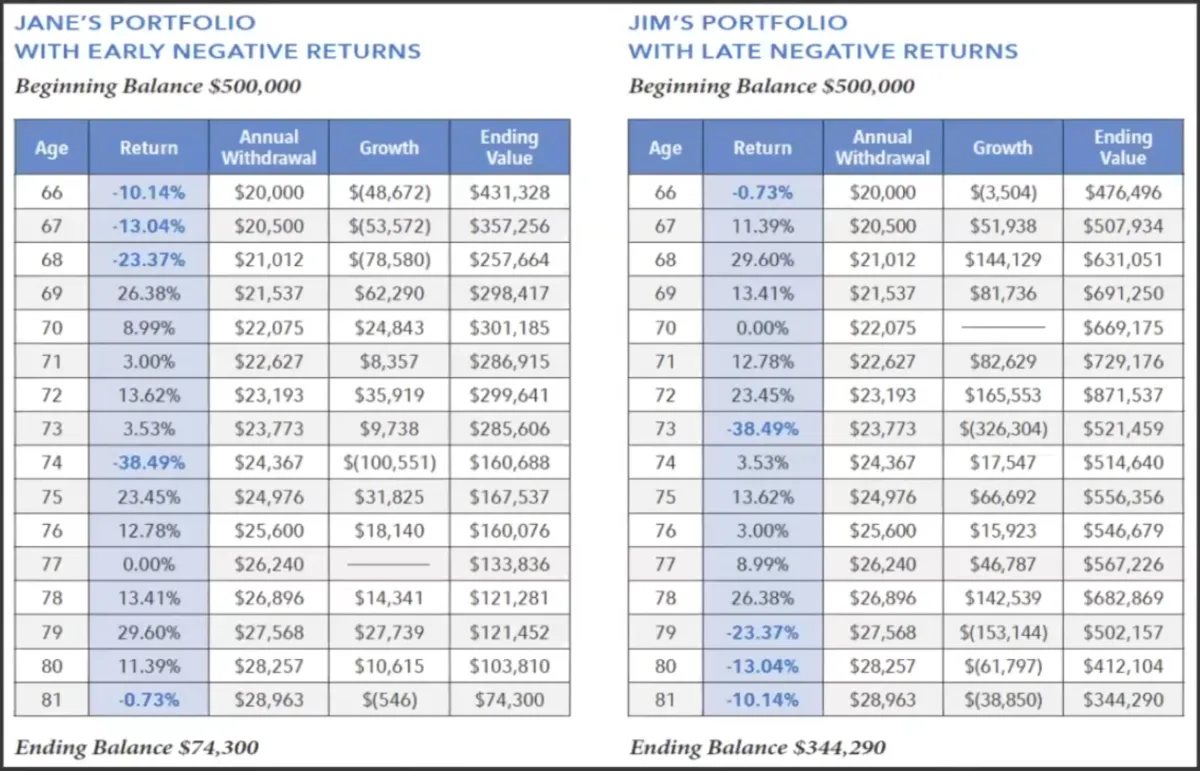

Market Volatility and the Sequence of Returns

Market volatility and the sequence of returns can drastically affect retirement outcomes—even when two investors have the same “average” rate of return. Jane and Jim both start with $500,000 and withdraw the same amount annually, but Jane’s early years coincide with steep market losses while Jim’s begin during periods of growth. The result is staggering: Jane’s account dwindles to less than $75,000 by age 81, while Jim’s still exceeds $340,000. The difference isn’t in performance—it’s in timing. Losing value early in retirement while taking withdrawals magnifies losses and shortens portfolio life. This is why income diversification and risk-managed tools like Fixed Indexed Annuities (FIAs), cash value life insurance, and guaranteed income strategies are essential. They protect against timing risk, ensuring your income remains consistent regardless of market swings.

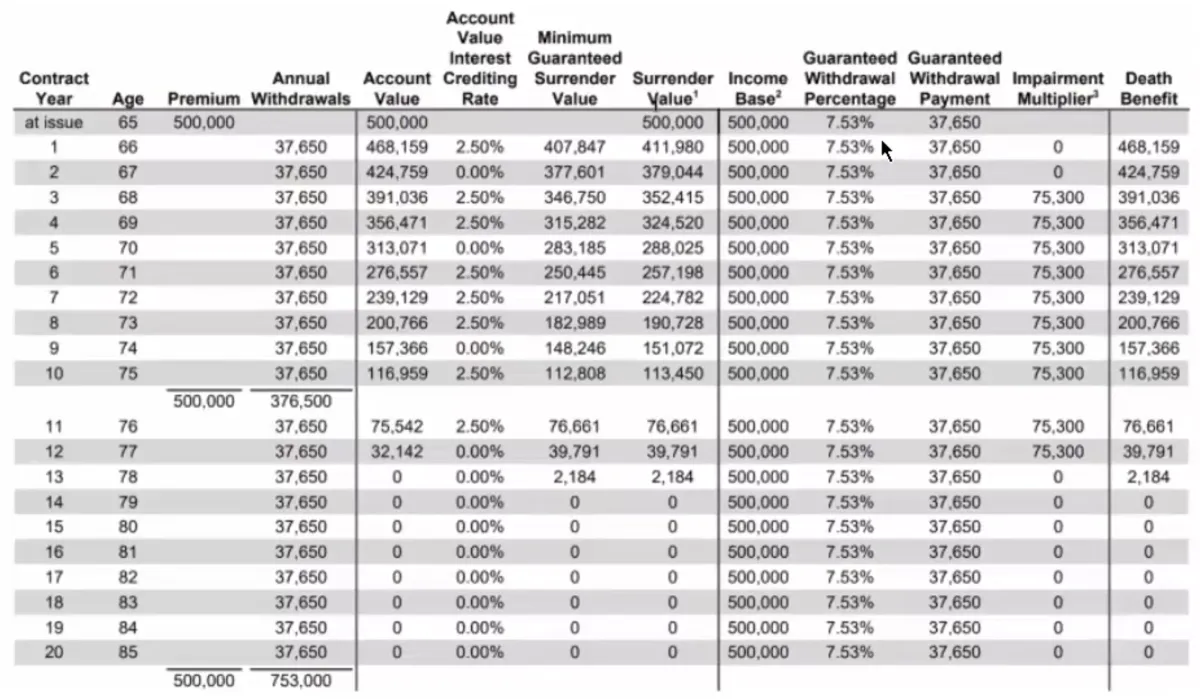

Fixed Indexed Annuity and Traditional Planning

In this case study, we are looking into using one using a Fixed Indexed Annuity (FIA) for guaranteed income versus the traditional investment-only approach. The traditional plan relies entirely on market performance and follows the outdated 4% withdrawal rule, leaving the retiree vulnerable to volatility, sequence of returns risk, and rising taxes. By contrast, the FIA-based plan reallocates a portion of assets into an annuity that guarantees income for life, regardless of market conditions. This retiree enjoys steady income even in down years, avoiding the stress of timing the market or cutting spending. The results show that with an FIA, income can increase from roughly 4% to over 7% without additional savings, risk, or work—providing stability, confidence, and protection against running out of money. It’s a clear example of how proper planning replaces uncertainty with control and ensures that retirement income lasts as long as you do.

Where we come in

Every financial decision you make today shapes the comfort and confidence you’ll have tomorrow. The difference between uncertainty and peace of mind isn’t luck—it’s strategy. Our consultations are not sales calls; they’re clarity sessions designed to show you exactly where you stand, how long your income will last, and what steps can secure your retirement once and for all. Whether you’re five years from retirement or already there, the right plan can turn worry into freedom. Schedule your FREE CONSULTATION TODAY and discover how to protect your wealth, reduce taxes, and build a retirement that truly works for you.